Four Ways to Increase your Retirement Plan’s Participation Rate

Nate Moody, CPFA®, Retirement Advisor

APril 2023

There are many benefits to offering the people in your organization a retirement plan. There are tax benefits and there are recruiting/retention benefits, but the most important benefit of all is helping your people save enough to have a comfortable retirement. By helping your employees achieve this goal and retire on time, you can create workforce development opportunities, you can lower your healthcare costs, and you have an army of engaged advocates at your organization who will know that you truly care about them.

However, there’s never been more things we’re told we’re supposed to be saving for. ‘You have to save for retirement, for a house, for healthcare, for college, to pay off debt,’ the list goes on and on. In this article, we outline four ways in which you can boost your employees’ retirement savings rates.

1. Automatic Features

Often, one of the most powerful forces facing us is ironically, our own inertia. However, through automatic features, we can turn inertia into one of our most powerful allies. As a plan sponsor, you are able to adopt plan features such as automatic enrollment and automatic escalation. In the absence of these plan features, the default is an employee never saving for retirement unless they take a proactive action. What these features do is change the default outcome to one where an employee is actively saving for retirement, unless they take proactive action not to do so.

Enhanced 401(k) Design Results

The proof is in the pudding. The average participation rate in plans with automatic enrollment is 82% versus just 55% amongst those that do not1. This is especially true for younger workers—76% of workers age 20-24 participate in plans with automatic enrollment whereas just 20% do for those plans without it1. We all know how powerful those 401(k) contributions in our 20s and 30s can be down the road.

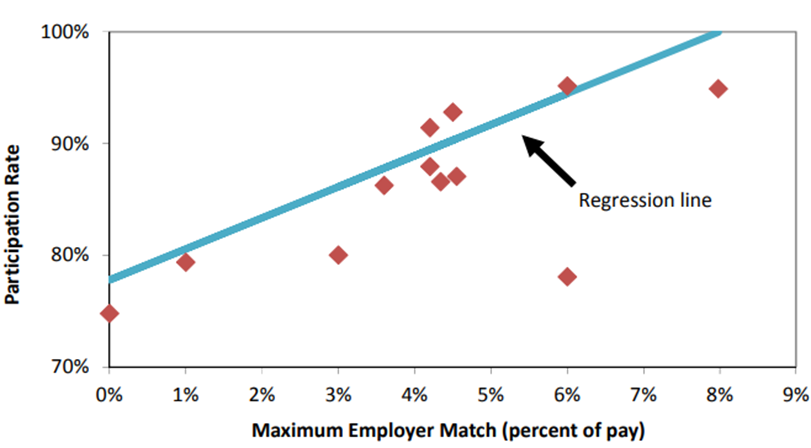

2. Employer Match

One of the most common ways of incentivizing an employee to save for retirement is to provide a match. Research finds that there is a direct correlation between an employer’s match and the participation rate2. However, be wary of the signal your match formula may subconsciously send your employees. For example, by matching 100% up to 3%, an employee may perceive that as meaning 3% is an adequate savings rate for them. Consider instead a ‘stretch match’ such as 50% up to 6%. The ultimate cost to the employer is the same, but it encourages the employee to save at least 6% in order to receive the full match.

That being said, in today’s tight labor market, ‘stretch match’ formulas like this are being replaced with more generous arrangements and, increasingly, Safe Harbor plan designs. Please ask your Lebel & Harriman Retirement Advisor whether your employer match is competitive for your industry and incentivizing the right employee behavior.

Matching Contributions and Savings Plan Participation in Firms with Automatic Enrollment

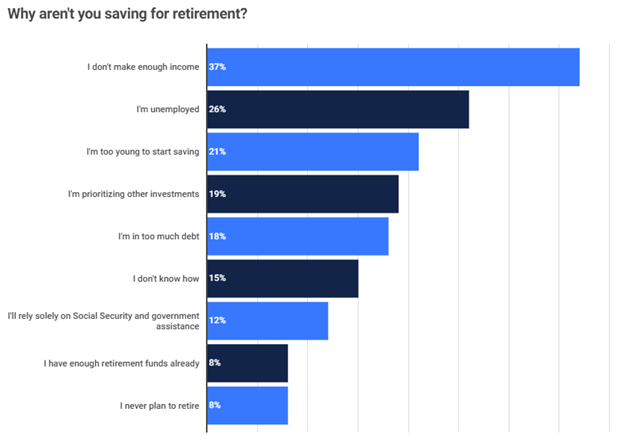

3. Education

While not as powerful as automatic features or financial incentives, education on the importance of saving for retirement, how to save for retirement, and when to start saving for retirement is crucial. A recent survey showed that among the top reasons for why people aren’t currently saving for retirement is that they ‘are too young to start saving’ (21%) or that they ‘don’t know how to start saving’ (15%)2. Both of these barriers can be addressed through education. Lebel & Harriman offers group & one-on-one education as well a monthly financial wellness webinar & newsletter – please encourage your employees to take advantage.

4. Unlocking their Paycheck

Lastly, the number one barrier to people saving more for retirement is not being able to afford to (37%)2. While you might not be able to increase their pay, there may be opportunities for you to free up some of their paycheck to go towards retirement. Consider ancillary employee benefits that can strengthen your recruiting/retention efforts while also unlocking your employees’ paychecks. A specific example that’s gaining significant traction is a student loan assistance benefit. By reimbursing an employee for their student loan payments, not only might your organization be eligible for tax incentives, but your employee has more discretionary income to be used towards saving for their retirement. You can learn more here: https://lebelharriman.com/student-loan-assistance-strategies-for-employers/.

As always, your Lebel & Harriman team can help. Please feel free to reach out to discuss which of these might make sense for your organization. Whether we like it or not, employees are increasingly looking towards their employers to help them navigate the many financial hurdles they face throughout their careers. By rising to the challenge and embracing that role, you can differentiate yourself as an employer-of-choice while also unlocking your employees’ full potential.

Sources

- https://www2.deloitte.com/us/en/insights/focus/behavioral-economics/overcoming-behavioral-bias-in-retirement-security-planning.html

- https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Documents/w18220.pdf

- https://anytimeestimate.com/research/retirement-savings-2022/#why-americans-are-not-saving-for-retirement

The information presented here is for educational purpose only and is not intended to provide specific advice or recommendations for any individual, nor does it take into account the particular investment objectives, financial situation, or needs of individual investors. All examples are hypothetical and are for illustrative purposes only.